Diabetes Device Choices

Overview

Sensor & Pump

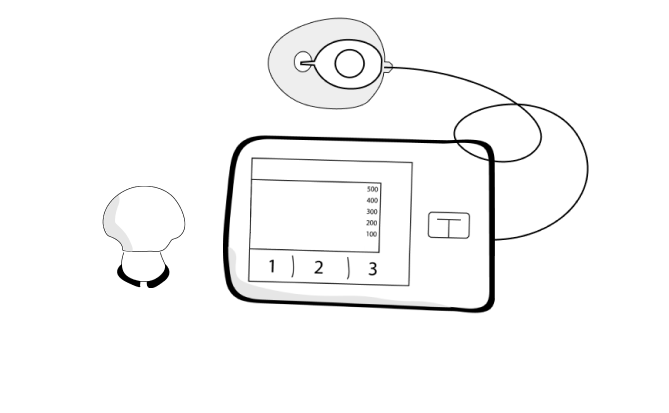

Dexcom G6 & Omnipod

Omnipod is the only tubeless pump option. This paired with the G6 is a common choice for active people.

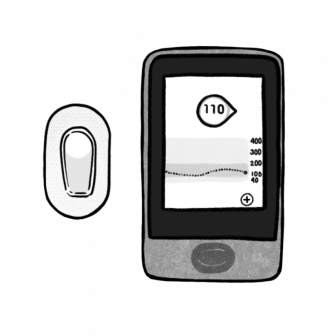

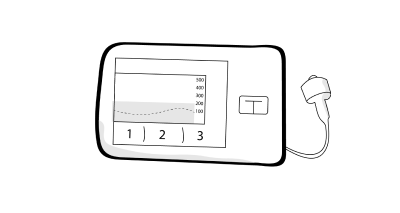

Sensor & Pump

Medtronic Sensor & Tandem Pump

With a pump and sensor you have a lot of manual control. The Tandem pump allows you to bolus directly from a compatible iOS or Android smartphone.

Priority: Overall

Next Steps

You're going to do great on the devices you choose

Talk to your provider to get a prescription. Advocate for yourself with a list of reasons why you believe it is best for your lifestyle.

Talk to the device companies about the device you want and if your insurance will cover it. They can help with this.

Many insurance companies require documentation of different qualifications before approving diabetes device coverage. every insurance company is different but some common qualifications include checking your blood sugar 4-6 times per day or having frequent low blood sugars. Understanding what qualifications are necessary for device coverage before starting the approval process can make things a lot easier.

Visit https://diabeteswise.org/resources/getting-treatment/qualify-for-insurance/ for more resources.

Questions for your Doctor

Dexcom G6 & Omnipod

Can I try this before I commit to it?

A lot of provider offices have sample devices you can touch and feel to get a sense of how they work. Some offices even have a trial device you can use for week to see how it works for you.

Medtronic Sensor & Tandem Pump

Can I try this before I commit to it?

A lot of provider offices have sample devices you can touch and feel to get a sense of how they work. Some offices even have a trial device you can use for week to see how it works for you.

Questions for your insurance

Many insurance companies require documentation of different qualifications before approving diabetes device coverage. Every insurance company is different, but some common qualifications include checking your blood sugar 4-6 times per day or having frequent low blood sugars. Understanding what qualifications are necessary for device coverage before starting the approval process can make things a lot easier.

Talk to the device companies

Dexcom G6

Call Dexcom and ask them about your coverage. Talk to your Doctor to get a prescription.

1-888-738 3646 Dexcom WebsiteOmnipod

Call Omnipod and ask them about your coverage. Talk to your Doctor to get a prescription.

1-800-591-3455 Omnipod WebsiteGuardian Connect

Call Medtronic and ask them about how much it will cost with your insurance coverage. Talk to your Doctor to get a prescription.

1-800-646 4633 Medtronic WebsiteTandem t:slim X2

Call Tandem and ask them about your coverage. Talk to your Doctor to get a prescription.

1-877-801-6901 Tandem WebsiteAdditional Resources

By Priorities

Active Lifestyle

Active Lifestyle

Avoiding Highs and Lows

Avoiding Highs and Lows

Comfort

Comfort

Easy Insulin Dosing

Easy Insulin Dosing

Easy to Use

Easy to Use

Fewer Fingersticks

Fewer Fingersticks

Privacy

Privacy

Cost & Coverage

Dexcom G6

Guardian Connect

Glucose Testing Supplies

Sensors

Transmitter

Receiver (1 time purchase)

Sensors

Transmitter

Glucose Testing Cost Estimate

Startup $80 to $239

Monthly $35 to $105

These prices vary by Insurance. Many insurers support the G6 Dexcom. It may be covered under durable medical goods or a pharmacy benefit.

Startup $69 to $206

Monthly $32 to $97

These prices vary by Insurance. If you call Medtronic they will start a process to check exactly how much your costs will be. Generally Medtronic pumps and sensors are covered by private insurance and medicare. It may be covered under durable medical goods or a pharmacy benefit.

Omnipod

Tandem t:slim X2

Insulin Dosing Supplies

Pods

Reader

Insulin

Pump

Charger

Insulin Cartridges

Infusion Sites

Insulin Dosing Cost Estimate

Startup $5 to $1260 Monthly

Omnipod is now covered by Medicare and Medicaid as well as most private insurers.

Startup $5 to $6,995

Monthly $20 to $200